Massive BTC & ETH Options Expiry Today – What It Means for the Market

BTC and ETH Options Expiry: A $2.25B Shockwave

The crypto market is bracing for heightened volatility today, April 18, 2025, as a massive $2.25 billion in Bitcoin (BTC) and Ethereum (ETH) options are set to expire. With $1.97 billion in BTC contracts and $280 million in ETH contracts reaching maturity, traders are watching the charts closely, especially with prices hovering near key technical thresholds.

This expiry event isn’t just a regular date on the calendar; it’s a potential market-moving catalyst that could push BTC and ETH into sharp moves, especially in the hours following the expiry.

What Is Options Expiry and Why Does It Matter?

Options are financial derivatives that give holders the right (but not obligation) to buy or sell an asset, like BTC or ETH , at a predetermined price. On expiry days, many of these contracts either get exercised or expire worthless.

But there’s more at play than just numbers.

Enter the “max pain” theory —a level at which the most options expire worthless, causing the most financial loss to the highest number of option holders. Market makers and whales are often believed to try and influence prices toward this level to maximize gains.

For today:

- BTC Max Pain: $82,000

- ETH Max Pain: $1,600

As of this morning, Bitcoin is trading at $81,500, and Ethereum is around $1,580—just shy of their respective max pain levels .

Technical Charts Signal Mixed Momentum

On the technical side, things get even more interesting:

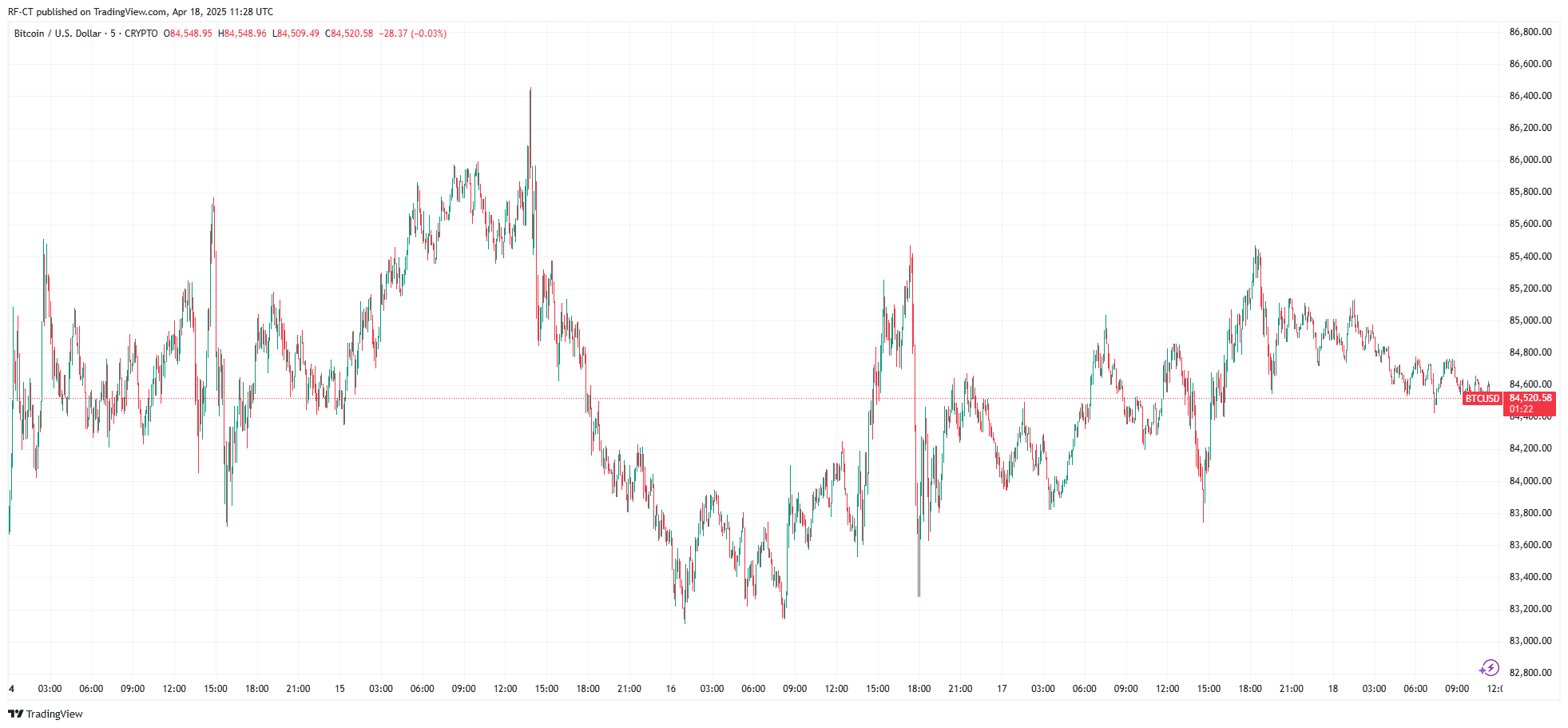

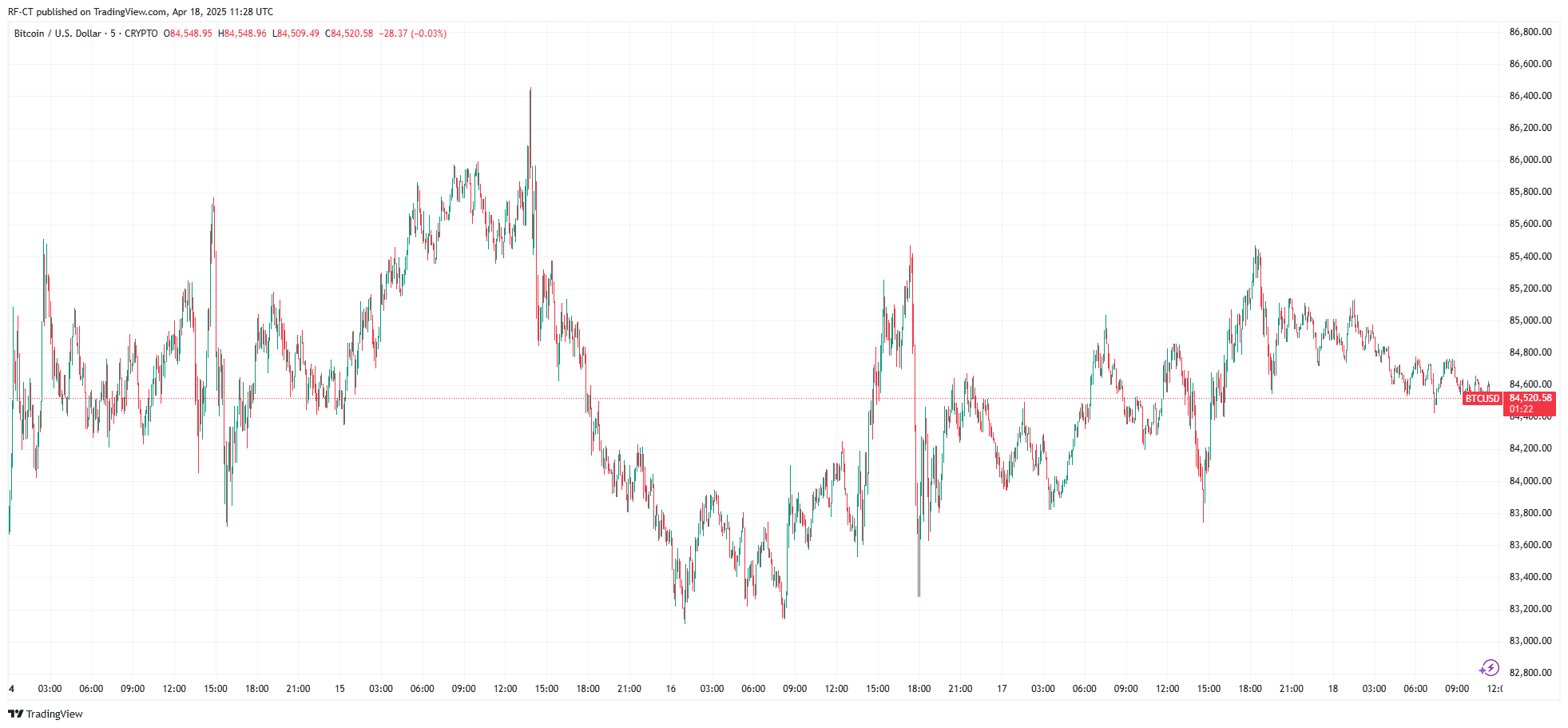

Bitcoin (BTC) Outlook:

- RSI sits near 58, indicating slight overbought pressure.

- The $82,000 level is acting as short-term resistance.

- A break above it could ignite a move toward $84,000–$85,000.

- Failure to reclaim $82K might lead to a pullback toward $79,000.

By TradingView - BTCUSD_2025-04-18 (5D)

By TradingView - BTCUSD_2025-04-18 (5D)

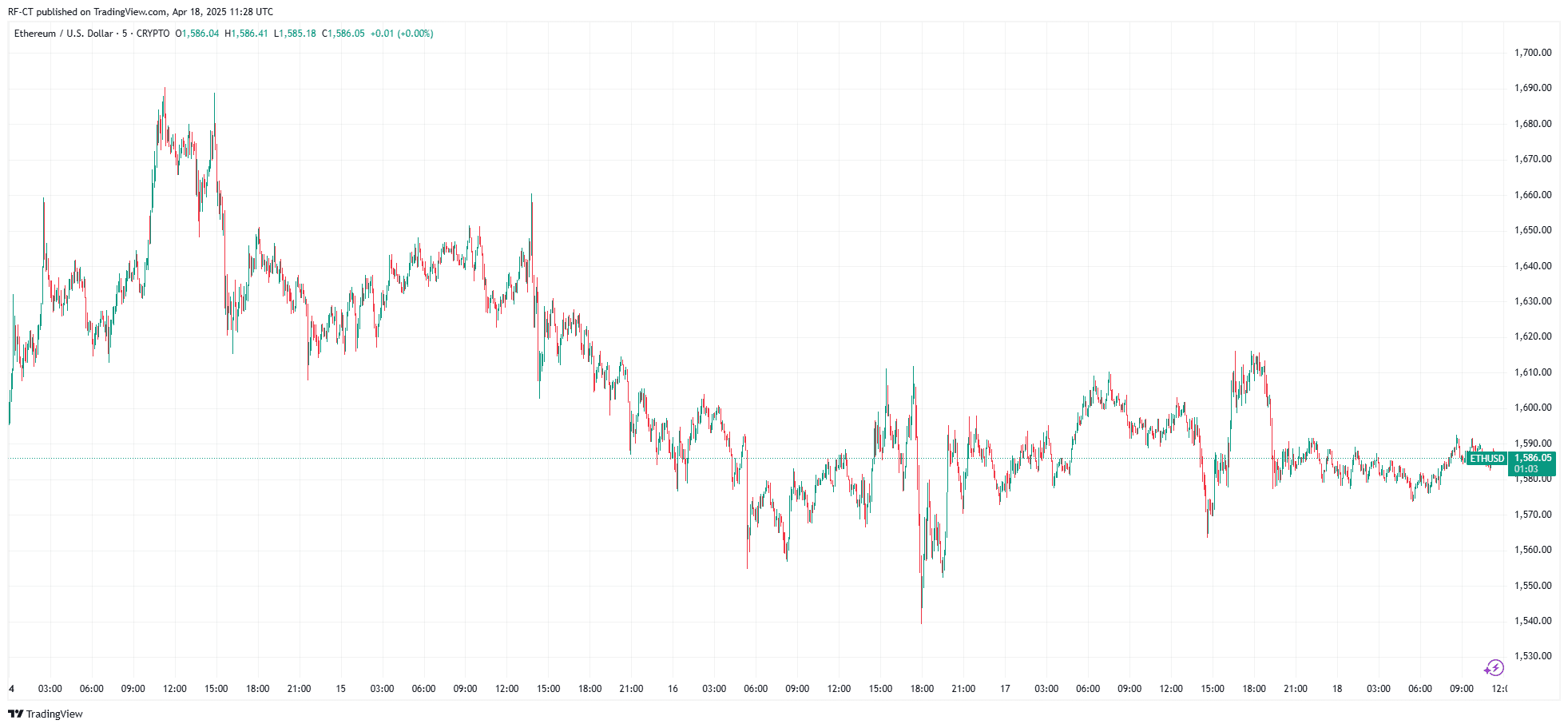

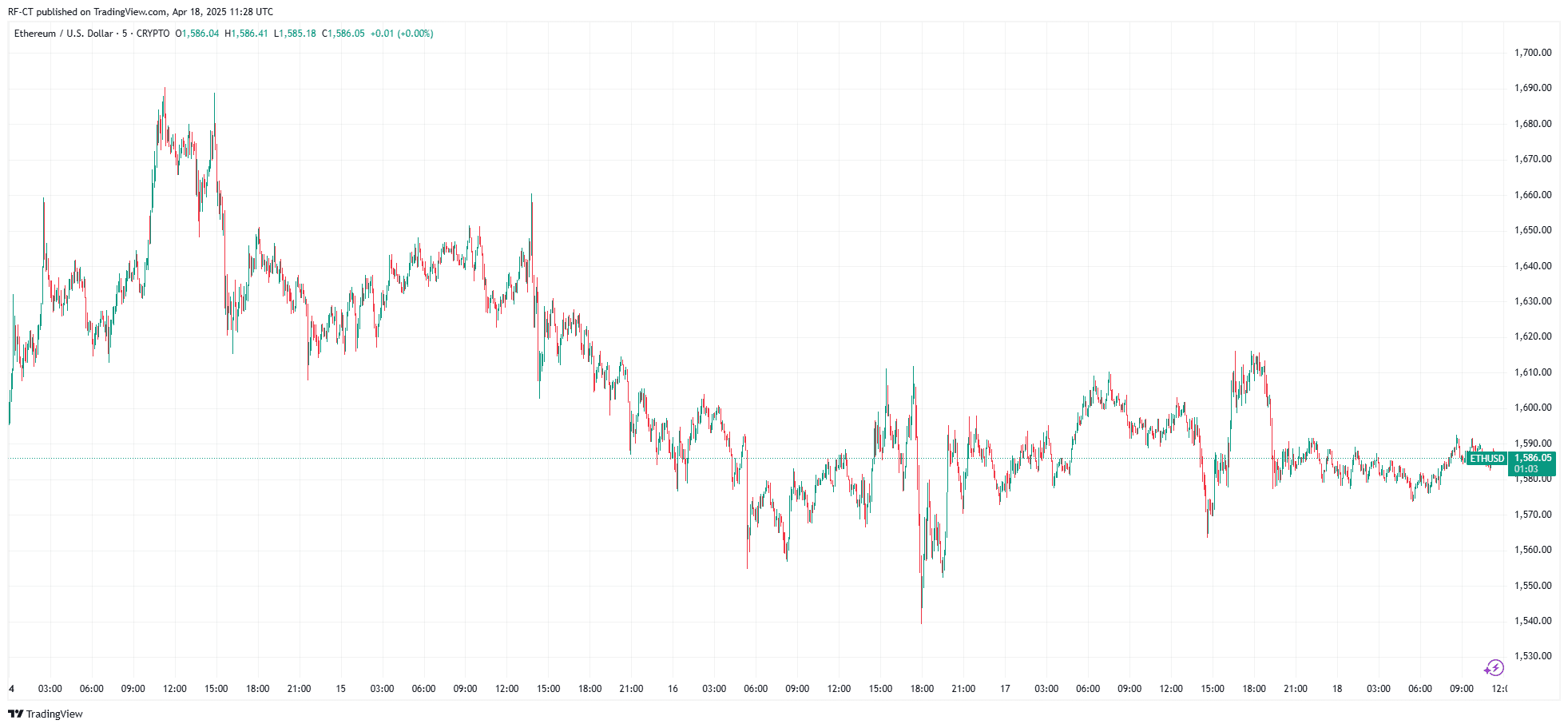

Ethereum (ETH) Outlook:

- ETH’s daily chart shows a bullish engulfing pattern, suggesting momentum may be shifting.

- Resistance lies near $1,620, while support remains firm at $1,550.

- Trading volume has picked up 15% on Uniswap, a sign of heightened activity.

By TradingView - ETHUSD_2025-04-18 (5D)

By TradingView - ETHUSD_2025-04-18 (5D)

Market Sentiment and Trader Behavior

Traders and market analysts are divided. Some believe whales will attempt to pin BTC and ETH near their max pain levels to let call options expire worthless. Others expect a post-expiry rally, as the market is “unshackled” from derivative pressure.

Adding fuel to the fire:

- BTC’s open interest has surged 12% in the past 24 hours.

- ETH perpetual futures funding rates are slightly positive, hinting at bullish bias.

With liquidity tight and speculation high, any sudden spike in volume could trigger cascading price moves.

What Comes Next?

While expiries often result in sideways trading or minor corrections, today’s setup looks different. With BTC hovering just $500 below its max pain level and ETH only $20 shy , even slight buying or selling pressure could cause meaningful moves.

Keep an eye on:

- The 4 PM UTC close, when most options contracts expire.

- The funding rates and volume spikes on major exchanges.

- Potential post-expiry relief rallies or breakdowns depending on whether the market breaks above or rejects key levels.

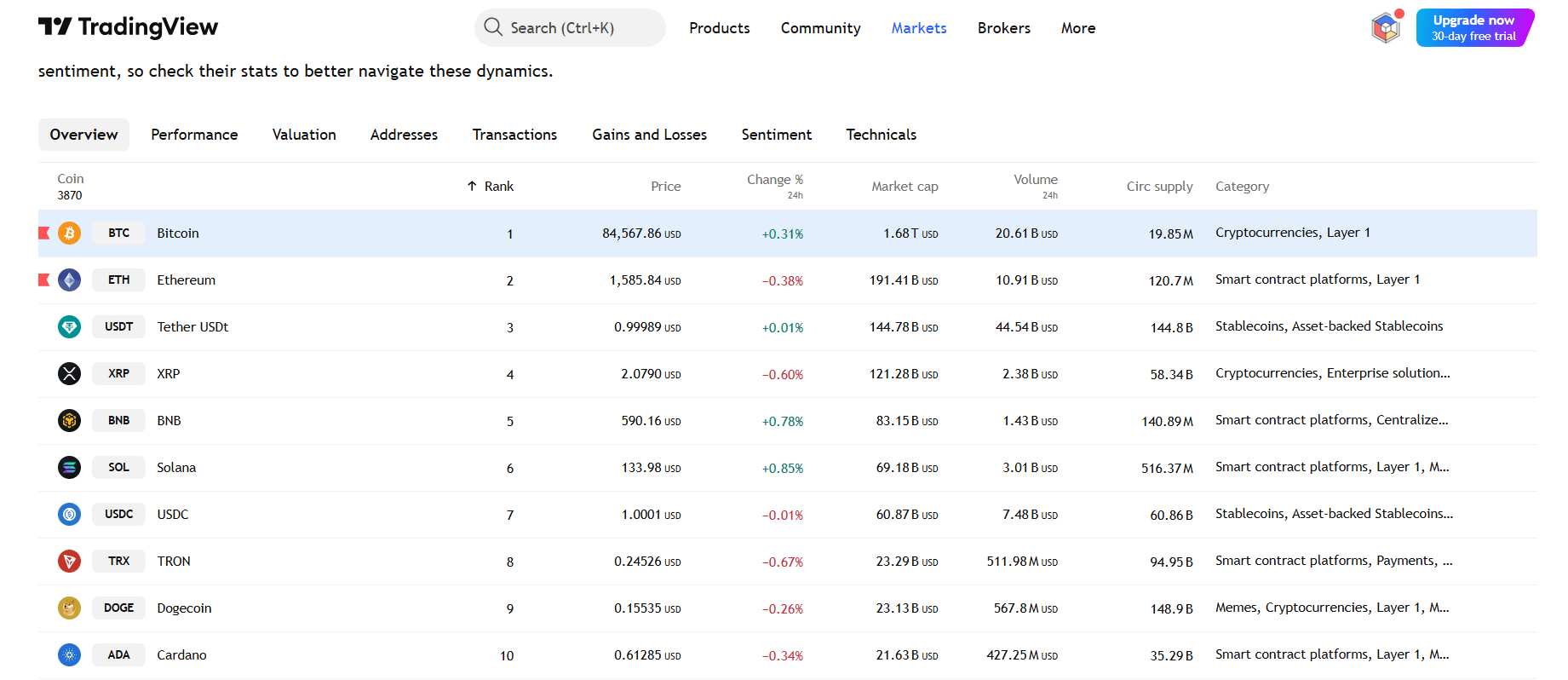

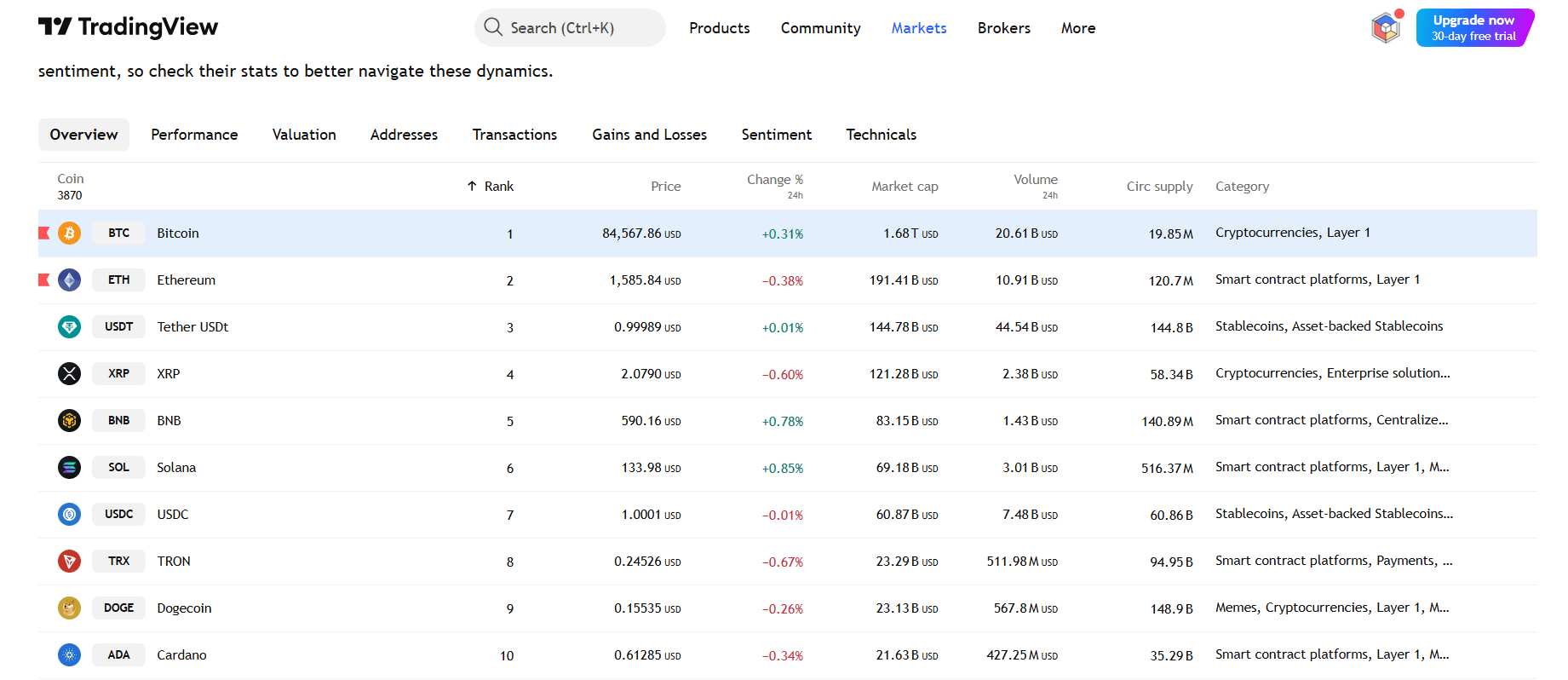

By TradingView - Top 10 Cryptos Performance Today

By TradingView - Top 10 Cryptos Performance Today

The stakes are high with $2.25 billion in crypto options expiring today. Traders and investors should brace for sudden shifts as the market processes this event. Whether you're a short-term speculator or a long-term holder, today's price action could set the tone for the next leg of the bull (or bear) cycle.

BTC and ETH Options Expiry: A $2.25B Shockwave

The crypto market is bracing for heightened volatility today, April 18, 2025, as a massive $2.25 billion in Bitcoin (BTC) and Ethereum (ETH) options are set to expire. With $1.97 billion in BTC contracts and $280 million in ETH contracts reaching maturity, traders are watching the charts closely, especially with prices hovering near key technical thresholds.

This expiry event isn’t just a regular date on the calendar; it’s a potential market-moving catalyst that could push BTC and ETH into sharp moves, especially in the hours following the expiry.

What Is Options Expiry and Why Does It Matter?

Options are financial derivatives that give holders the right (but not obligation) to buy or sell an asset, like BTC or ETH , at a predetermined price. On expiry days, many of these contracts either get exercised or expire worthless.

But there’s more at play than just numbers.

Enter the “max pain” theory —a level at which the most options expire worthless, causing the most financial loss to the highest number of option holders. Market makers and whales are often believed to try and influence prices toward this level to maximize gains.

For today:

- BTC Max Pain: $82,000

- ETH Max Pain: $1,600

As of this morning, Bitcoin is trading at $81,500, and Ethereum is around $1,580—just shy of their respective max pain levels .

Technical Charts Signal Mixed Momentum

On the technical side, things get even more interesting:

Bitcoin (BTC) Outlook:

- RSI sits near 58, indicating slight overbought pressure.

- The $82,000 level is acting as short-term resistance.

- A break above it could ignite a move toward $84,000–$85,000.

- Failure to reclaim $82K might lead to a pullback toward $79,000.

By TradingView - BTCUSD_2025-04-18 (5D)

By TradingView - BTCUSD_2025-04-18 (5D)

Ethereum (ETH) Outlook:

- ETH’s daily chart shows a bullish engulfing pattern, suggesting momentum may be shifting.

- Resistance lies near $1,620, while support remains firm at $1,550.

- Trading volume has picked up 15% on Uniswap, a sign of heightened activity.

By TradingView - ETHUSD_2025-04-18 (5D)

By TradingView - ETHUSD_2025-04-18 (5D)

Market Sentiment and Trader Behavior

Traders and market analysts are divided. Some believe whales will attempt to pin BTC and ETH near their max pain levels to let call options expire worthless. Others expect a post-expiry rally, as the market is “unshackled” from derivative pressure.

Adding fuel to the fire:

- BTC’s open interest has surged 12% in the past 24 hours.

- ETH perpetual futures funding rates are slightly positive, hinting at bullish bias.

With liquidity tight and speculation high, any sudden spike in volume could trigger cascading price moves.

What Comes Next?

While expiries often result in sideways trading or minor corrections, today’s setup looks different. With BTC hovering just $500 below its max pain level and ETH only $20 shy , even slight buying or selling pressure could cause meaningful moves.

Keep an eye on:

- The 4 PM UTC close, when most options contracts expire.

- The funding rates and volume spikes on major exchanges.

- Potential post-expiry relief rallies or breakdowns depending on whether the market breaks above or rejects key levels.

By TradingView - Top 10 Cryptos Performance Today

By TradingView - Top 10 Cryptos Performance Today

The stakes are high with $2.25 billion in crypto options expiring today. Traders and investors should brace for sudden shifts as the market processes this event. Whether you're a short-term speculator or a long-term holder, today's price action could set the tone for the next leg of the bull (or bear) cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BC.GAME Rebrands, Expands $BC Crypto Ecosystem

BC.GAME, a leading name in Web3 gaming, has unveiled a major brand overhaul, introducing a new logo, updated colour scheme, and the bold slogan “Stay Untamed.” The rebrand signals the company’s sharpened focus on crypto integration and its vision to build a global, community-driven Web3 entertainment ecosystem.

Ethereum Rally Stalls Near $2.58K as Holders Take Profits

Ethereum is priced at $2,438, marking a 3.5% decline in the last 24 hours after experiencing a 34% increase over the past week. According to data from Coinglass, open interest has fallen by 2%, suggesting a decrease in leveraged positions. This pullback comes after an impressive rally, during which ETH rose from $1,800 to over $2,500 in just a few days.

Truth Social Denies Memecoin Launch Amid Trump Token Controversy

Truth Social, the social media platform owned by Trump Media & Technology Group, has denied circulating rumours suggesting it is launching a memecoin. In an official post, the platform dismissed the speculation as false, reiterating that it had no involvement in any crypto token launch.

Record Inflows Boost Bitcoin ETFs and Digital Assets