Bitcoin News: More Sell Side Pressure Amid China, U.S Tariffs Face-Off

Bitcoin on the edge as Trump is reportedly set to raise tariffs against China to 104%. More short term pain? CryptoQuant analysis signals that this crash is shifting coins from weak to strong hands. Recovery hopes earlier this week triggered a surge in liquidations as sentiment remains in extreme fear.

In latest Bitcoin news, price kicked off this week with a bit of buying pressure that slowed down its downside after its bearish slide during the weekend.

However, the bears could regain dominance and push prices lower before the end of the week due to tariff war escalation.

Bitcoin and the crypto market at large have been waiting for things to cool down and for a buying opportunity after heavy discounts.

The bearish assault might not be over especially as tariff wars escalate between the U.S and China.

Trump’s administration previously announced that it would impose additional tariffs against China on Wednesday to at least 104%.

Meanwhile, China did not show any signs of backing down and even planned to retaliate.

The escalation between China and the U.S risks taking the tariff wars to the next level and further eroding market confidence.

This outcome could trigger more selloffs, with Bitcoin risking decline below $70,000.

Bitcoin News: Long Term Holders Absorbing Short Term Capitulation

Bitcoin dipped to a new local low of $74,434 on Monday, fueled by tariffs-related FUD.

CryptoQuant data revealed that the wave of sell pressure was largely due to sell pressure from short term holders.

Short term holders contributed roughly $10 million worth of liquidity outflows on Monday.

However, long term holders purchased $9 billion worth of the cryptocurrency, leaving a net $1 billion worth of downside.

This purchase by long term holders underscored the support that Bitcoin found just above $74,500.

But, the most important observation is that this recent dip demonstrated the flow of Bitcoin from short term holders to long term holders.

While the flow of Bitcoin from weak hands to diamond hands is a keen observation, it also warrants a look at how whale activity has been fairing.

Bitcoin large holder inflows surged from 58.01 BTC to 19.140 BTC between 5 and 7 April. A sign that whales accumulated a large amount of the cryptocurrency.

However, large holder outflows ticked higher indicating that short term inducement was at play.

Large holder outflows surged from 0 BTC to 12,570 BTC during the same period.

Bitcoin large holder flows/ source: IntoTheBlock

Bitcoin large holder flows/ source: IntoTheBlock

Where Is Bitcoin Market Headed?

Bitcoin market sentiment remained in the red, particularly in extreme fear territory.

It dipped from 24 to 18 in the last 24 hours, largely due to the risk of more downside as China and the U.S tariff wars intensify.

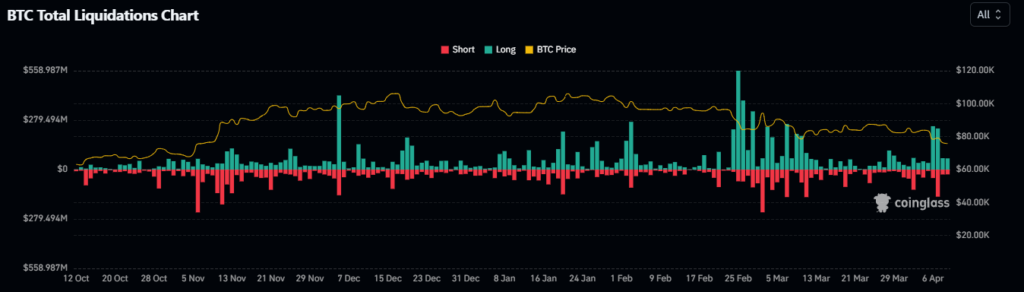

As a result, price continued to favor the downside and any rally attempts resulted in significant liquidations.

Bitcoin kicked off this week with a spike in long liquidations with almost $500 million worth of liquidations on Monday and Tuesday.

Bitcoin liquidations/ source: Coinglass

Bitcoin liquidations/ source: Coinglass

The liquidations observed in Bitcoin news on Monday and Tuesday marked the highest observed liquidation levels in the last 4 weeks.

The last time BTC liquidations were that high was in the first week of March. This observation also confirmed that derivatives investors have been expecting a recovery.

Nevertheless, whales have remained largely focused on extremely short term gains, especially on account of the extended tariff wars.

So, what should Bitcoin traders expect? As long as tariff wars remain active or escalate, the possibility of a strong recovery will most likely be off the table.

However, that could change if President Trump and his administration announce plans to hold negotiations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

German Chancellor-designate: Trump tariffs increase risk of financial crisis

Asia holds crypto liquidity, but US Treasurys will unlock institutional funds

[Initial Listing] Bitget Will List KernelDAO (KERNEL) in the Innovation, LSD and DeFi Zone.

Uniswap front-end transaction fees have reached $182.88 million