Ethereum’s Price Drop Signals Potential Buying Opportunities for Long-Term Investors

In Brief The recent price drop of Ethereum may offer strategic buying opportunities. Historical data supports potential recovery after dips below realized price. Investor psychology plays a crucial role during uncertain market conditions.

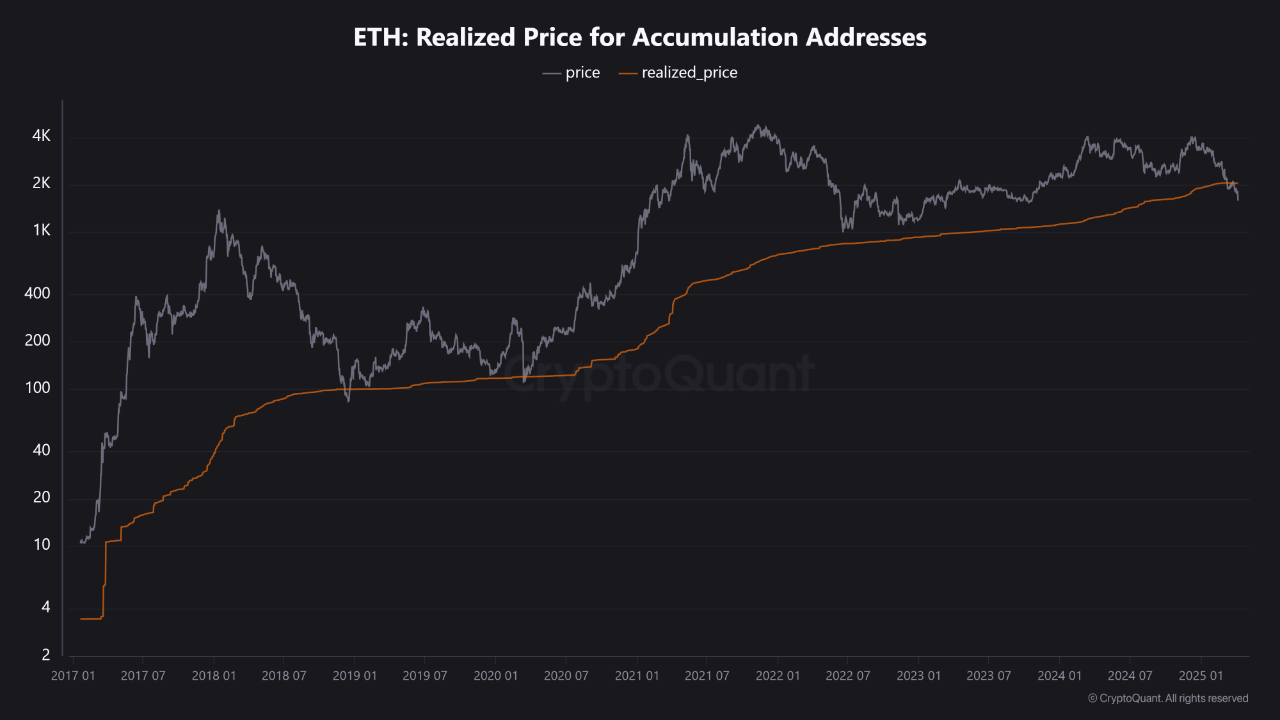

The price of Ethereum (ETH) $1,471 has recently dipped below the critical “realized price” threshold of $2,000, marking a significant point of concern. According to the analysis from the on-chain data platform CryptoQuant, this decline not only triggers short-term panic selling, but it may also signal a strategic accumulation zone for long-term investors. The realized price is calculated based on the value of each ETH at its last transfer on the blockchain , reflecting the actual cost average of the market. This metric provides a deeper perspective compared to the current market price, revealing the psychology of crypto investors at this level.

What is Realized Price and Why is it Important?

Realized price is derived from the average price of each ETH at its last movement, presenting a more realistic depiction of Ethereum’s market value. This metric can serve as a support or resistance level beyond just the market price, indicating the average cost for investors.

Ethereum ETH Realized Price

Ethereum ETH Realized Price

When Ethereum’s price falls below this level, most investors find themselves in a losing position, which significantly impacts their psychology, especially during periods of uncertainty. This creates an environment where selling pressure intensifies. However, a drop below the realized price isn’t always negative; historical data shows that periods when ETH tests these levels often precede strong recoveries after large sell-offs. Consequently, short-term fears might herald long-term opportunities.

What Do Historical Data Indicate for Ethereum?

According to on-chain data provided by CryptoQuant, periods when Ethereum’s price falls below the realized price indicate market bottoms 80% of the time. Even more interestingly, after these dips, ETH’s price has historically risen by an average of 217% over the subsequent six months. This suggests that current price levels carry both risks and potential rewards.

These statistics become particularly meaningful when combined with the psychology of investors. Major sell-offs typically occur during what is known as the “desperation phase,” where investors panic and sell due to lost confidence. However, this is precisely when strategic buying opportunities arise for long-term investors.

Though the recent downturn has caused panic in the short term, examining past cycles shows that these levels have often turned into valuable opportunities over time. This highlights the necessity for investors to focus not just on price, but also on context.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PEPE Price Prediction: Will the Memecoin Hit Its December High Again?

Mantle (MNT) Heading Toward Key Support – Double Bottom Setup Hints at a Possible Reversal

CORE Approaches Key Resistance – Could Breakout Spark a Recovery?