Bitcoin Price Poised to Explode as M2 Money Supply Soars

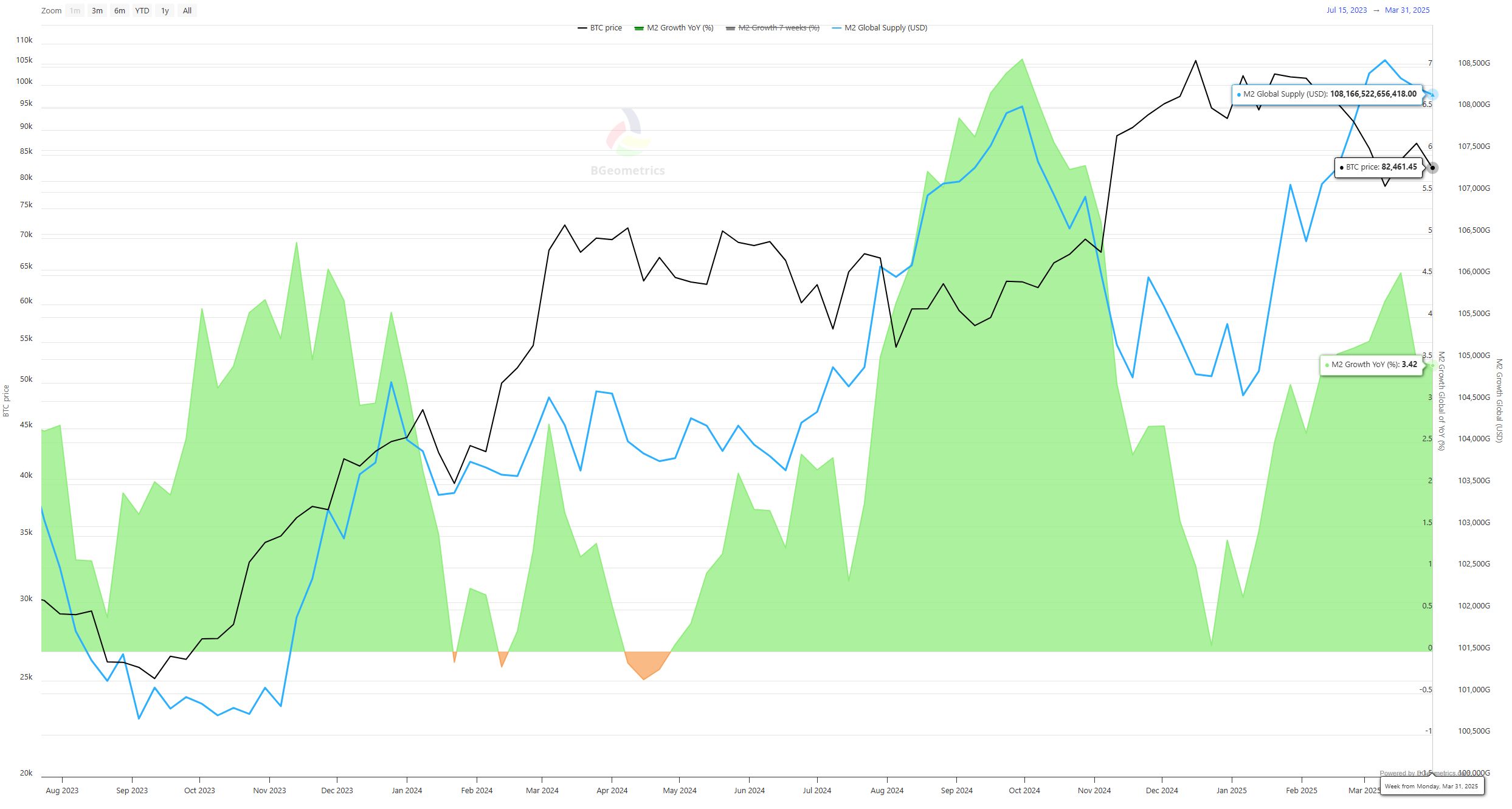

- Global M2 money supply has reached a record $108.4 trillion, signaling more liquidity in the financial system.

- Past M2 surges have preceded major Bitcoin rallies, and analysts expect a similar pattern to play out.

The global M2 money supply has recently reached an astonishing $108.4 trillion, and this means that the price of Bitcoin has the potential to rise to new heights. The selloff recently saw Bitcoin facing another two weeks of volatility and macro pressure, and now, as central banks pour more liquidity, analysts are closely watching Bitcoin’s response.

M2 consists of currency, demand, savings, and other deposits. The expansion of M2 in the past has been associated with movements in risk-on assets. Bitcoin, especially since it is a scarce digital asset with a limited number of tokens, tends to thrive in such conditions of unprecedented monetary expansion. M2 increased by more than 25% from the COVID-19 stimulus measures compared to this year’s digital asset surge from below $10,000 to over $69,000.

Recent moves echo that trend. M2 has been on an upward trend since late February, which can indicate a delayed but powerful impulse to increase the Bitcoin rate. Analysts based on M2 estimated that Bitcoin’s price usually lags behind by about two months of growth. If this pattern persists, there is the possibility of a breakout if liquidity remains high.

Bitcoin Shrugs Off Panic as Wall Street Slides

Unlike other markets, Bitcoin revealed its stability during this period. On April 4, under pressure from Trump’s new “Liberation Day” tariffs and China’s 34% responsive measures, U.S. stocks were down $3.25 trillion in two days. Yet, Bitcoin increased to $84,639, what several analysts refer to as a persistent and rather distinct “decoupling.”

Federal Reserve Chair Jerome Powell said the tariffs could harm the economy by raising inflation and reducing growth rates. He also admitted that inflation may rise above the central bank target of 2% in the future. Still, Trump called for rate cuts through Truth Social, criticizing Powell for being “too late.”

As equities stumbled, Bitcoin outperformed. This divergence is catching the eye of analysts, who said that it is starting to act more like a hedge against standard risk. Cory Bates, a market analyst, has said, “Bitcoin is decoupling right before our eyes.”

Rising Support for Bitcoin as a Safe-Haven Asset

Michael Saylor, executive chairman of MicroStrategy, recently rebranded as Strategy, echoed the sentiment. He called Bitcoin the “ most liquid, salable, 24/7 asset on Earth ” and stated that during panic, people use spare liquidity to sell liquid assets. Saylor ticks it down to temporary correlation by saying that in the long term, Bitcoin behaves differently.

Eric Weiss, the founder of the Blockchain Investment Group, took it a step further. He stated that Bitcoin stands as a “mathematical solution” for high-risk classes of assets. “No earnings risk. No geopolitics. Just math,” he wrote. Weiss anticipated that Bitcoin would decouple from equities dramatically as institutional fund inflows are expected to rise.

As the tariff war escalates and stocks bleed, Wall St will eventually realize there’s an alternative: Bitcoin. No earnings risk. No geopolitics. Just math. The moment capital truly pivots, BTC doesn’t just hold up, it outperforms dramatically.

— Eric Weiss ⚡️ (@Eric_BIGfund) April 4, 2025

However, there are still some inflationary pressures, but the job numbers have remained solid. In March, 228,000 nonfarm jobs were created, while the unemployment rate ticked up slightly to 4.2%. However, these indicators have not been enough to bring stability to equity markets.

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano founder Hoskinson accused of hijacking $619 million

Stablecoin bill tanked, Democrats slammed for playing

Ethereum Classic ($ETC) Eyes a 510% Breakout Rally

Ethereum Classic could surge over 510% to $127.65 as a major breakout pattern emerges.Why the $127.65 Target MattersShould You Pay Attention?

Doginme Made Early Buyers Rich—Now Arctic Pablo Coin Is Leading the Next Meme Coin Gold Rush

While Doginme showed how fast gains can arrive in meme markets, Arctic Pablo Coin is showing how they can be structured, incentivized, and sustainable.Doginme: The Meme Token That Ran With the Big DogsArctic Pablo Coin’s 66% APY: The Meme Coin Presale With Real UtilityIceberg Isle and the Numbers That Matter: $0.000125 Entry, 6,300% ROIArctic Pablo Coin Is Built for the Long Run: Why It Belongs Among the Top New Meme Coins for Exponential Returns