SEC Eases Rules for Stablecoins, Creating New Opportunities in the Market

In Brief The SEC has relaxed its regulations on certain stablecoins, fostering market opportunities. New "Covered Stablecoin" category excludes compliant stablecoins from being classified as securities. User returns and interest on Covered Stablecoins remain restricted under the new rules.

The U.S. Securities and Exchange Commission (SEC) has softened its stance on certain stablecoins. The regulatory body announced that it will not classify specific stablecoins as securities if they meet certain conditions. This decision signifies that these altcoins will remain outside the purview of SEC oversight, a significant development for altcoin projects battling regulatory uncertainty.

Introduction of “Covered Stablecoin” Definition

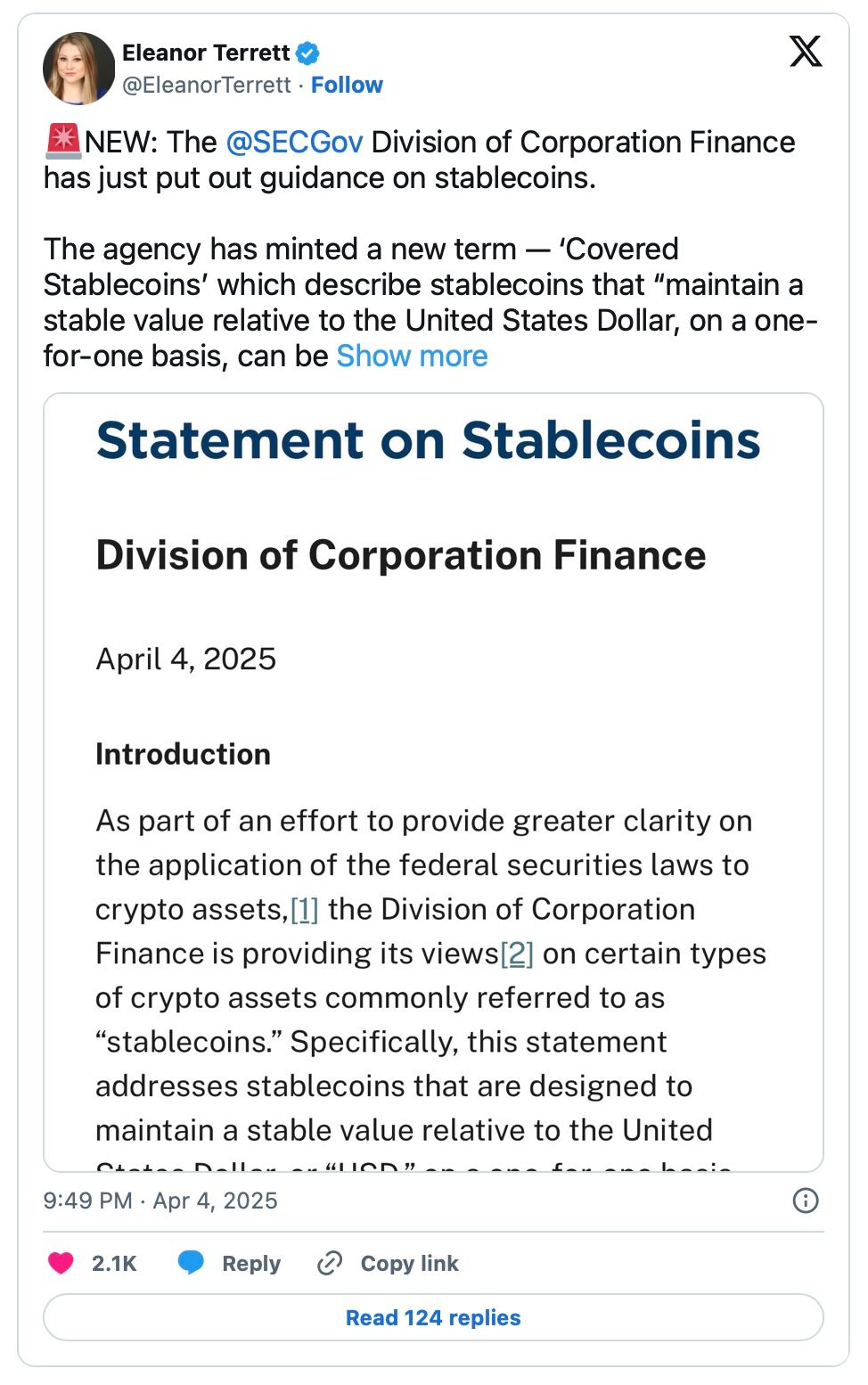

According to Fox Business reporter Eleanor Terrett, the SEC has established a new category called “Covered Stablecoin.” Coins in this category are designed to always maintain a 1:1 ratio with the U.S. dollar. Furthermore, their value must be backed by safe, liquid assets, and the total value of these assets must equal or exceed the amount of stablecoins in circulation.

SEC Altcoin – Stablecoin Decision

SEC Altcoin – Stablecoin Decision

Stablecoins that meet these criteria will no longer fall under the SEC’s definition of securities. As a result, these coins will be able to trade in the market without SEC approval and regulation. This decision has been particularly reassuring for major, compliant stablecoin projects like Circle’s USDC and PayPal’s PYUSD.

However, this relief does not apply to all stablecoins. The SEC emphasized that coins with algorithmic structures, those offering interest or yield, or those whose value is tied to assets like gold or foreign currencies fall outside this new category. Such coins may still be considered securities and could face regulatory penalties.

No Distribution of Interest Income to Users

While the SEC’s approach provides some flexibility, it imposes a significant restriction for users. Altcoins categorized as Covered Stablecoins cannot offer interest or any returns. Although companies issuing these stablecoins can earn interest income from their reserves, they are not permitted to share this income with users.

This aspect drew criticism from Coinbase CEO Brian Armstrong, who urged Congress to amend the legal framework to allow users to earn interest without being classified as securities. He argued that prohibiting returns for users could stifle innovation in the cryptocurrency sector.

Circle’s President Heath Tarbert expressed satisfaction with the SEC’s decision, highlighting that only stablecoins genuinely backed by U.S. dollars will fall under this category, which is positive for market security.

Meanwhile, regulatory efforts regarding stablecoins are gaining momentum in the U.S. Congress. Both the House of Representatives and the Senate are advancing stablecoin proposals with bipartisan support. As the election period approaches, cryptocurrencies and stablecoins have become hot topics on the political agenda.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — PAXG/USDT!

Market Expert Warns of Potential Decline in Major Cryptocurrencies

In Brief Jason Pizzino warns of further losses in XRP, Solana, and Ethereum. Technical indicators suggest continued downward trends for these cryptocurrencies. Market corrections prompt investors to stay informed on price projections.

Strategy pauses Bitcoin buys as unrealised losses hit $5.91B

ZKasino scammer loses $27M after Ethereum liquidation