Bitcoin holds steady amid stock market crash, says Unchained analyst

As the stock market declines due to U.S. tariffs on most of its trading partners, Bitcoin has shown some resilience. An expert at Unchained explains why.

US stocks have seen some of the worst performance in years. However, Bitcoin (BTC) showed relative resilience, which is great news for institutional investment, explains Joe Burnett, Director of Market Research at the crypto financial firm Unchained.

On April 4, the Dow Jones Industrial Average shed more than 2,200 points, adding to Thursday’s decline of 1,679 points. This was the worst two-day performance in history, leaving many equity investors anxious over the weekend.

At the same time, Bitcoin showed relative resilience , even starting to recover, and actually registered a 2.2% gain in the last 24 hours. Burnett suggested that this is a repeat of the pattern from 2020, when Bitcoin prices led the market recovery.

Recalling March 2020, bitcoin rapidly bottomed and recovered first (before U.S. equities), a pattern potentially repeating today as bitcoin hasn’t made new lows since March 11th.

Due to Bitcoin’s high volatility, Burnett said it is often the first asset investors sell when liquidity dries up. However, because the selloff is typically fast and aggressive, Bitcoin often bottoms before equities.

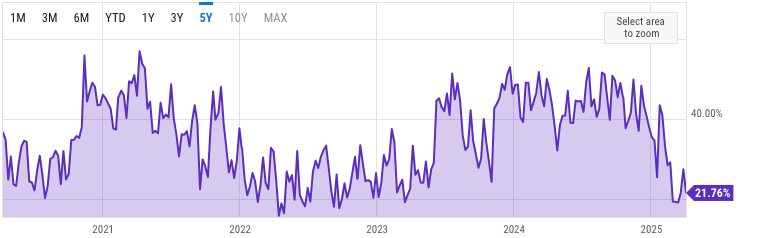

This may also indicate that stocks are nearing a bottom. Supporting this view is the AAII investor sentiment survey, which fell to 19.11% on March 13, the lowest level since the pandemic. This extreme negative outlook could mean that stocks are set for a reversal.

Still, Burnett cautioned that this does not guarantee Bitcoin is out of danger.

Of course, if stocks continue falling aggressively over the coming weeks, it’s reasonable to expect that bitcoin could experience another leg down too.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano founder Hoskinson accused of hijacking $619 million

Stablecoin bill tanked, Democrats slammed for playing

Ethereum Classic ($ETC) Eyes a 510% Breakout Rally

Ethereum Classic could surge over 510% to $127.65 as a major breakout pattern emerges.Why the $127.65 Target MattersShould You Pay Attention?

Doginme Made Early Buyers Rich—Now Arctic Pablo Coin Is Leading the Next Meme Coin Gold Rush

While Doginme showed how fast gains can arrive in meme markets, Arctic Pablo Coin is showing how they can be structured, incentivized, and sustainable.Doginme: The Meme Token That Ran With the Big DogsArctic Pablo Coin’s 66% APY: The Meme Coin Presale With Real UtilityIceberg Isle and the Numbers That Matter: $0.000125 Entry, 6,300% ROIArctic Pablo Coin Is Built for the Long Run: Why It Belongs Among the Top New Meme Coins for Exponential Returns