Bitcoin Struggles Below $85,000 as Investors Show Caution and Long-Term Optimism

-

Bitcoin’s price grapples beneath $85,000 as investor caution surfaces, revealing a significant drop in circulation and market sentiment.

-

Despite turbulent market conditions, long-term holders remain optimistic, showcasing a strong commitment to Bitcoin amidst external shocks.

-

“The recovery hinges on reclaiming $85,000 as support,” analysts suggest, with $80,301 marking the next critical support threshold if bearish trends persist.

Bitcoin struggles below $85,000, but long-term holders remain steadfast. Will Bitcoin reclaim crucial support to reverse recent losses?

Investor Sentiment and Market Dynamics in Bitcoin

Bitcoin’s ongoing challenge to surpass the critical $85,000 resistance level has sparked discussions about the overall investor sentiment within the crypto market. Recent trends indicate that while price recovery has been sluggish, the behavior of long-term holders is telling a different story. Investors, who typically hold their assets for extended periods, are demonstrating remarkable resilience, indicating potential recovery signs.

The Role of Long-Term Holders in Stabilizing Bitcoin

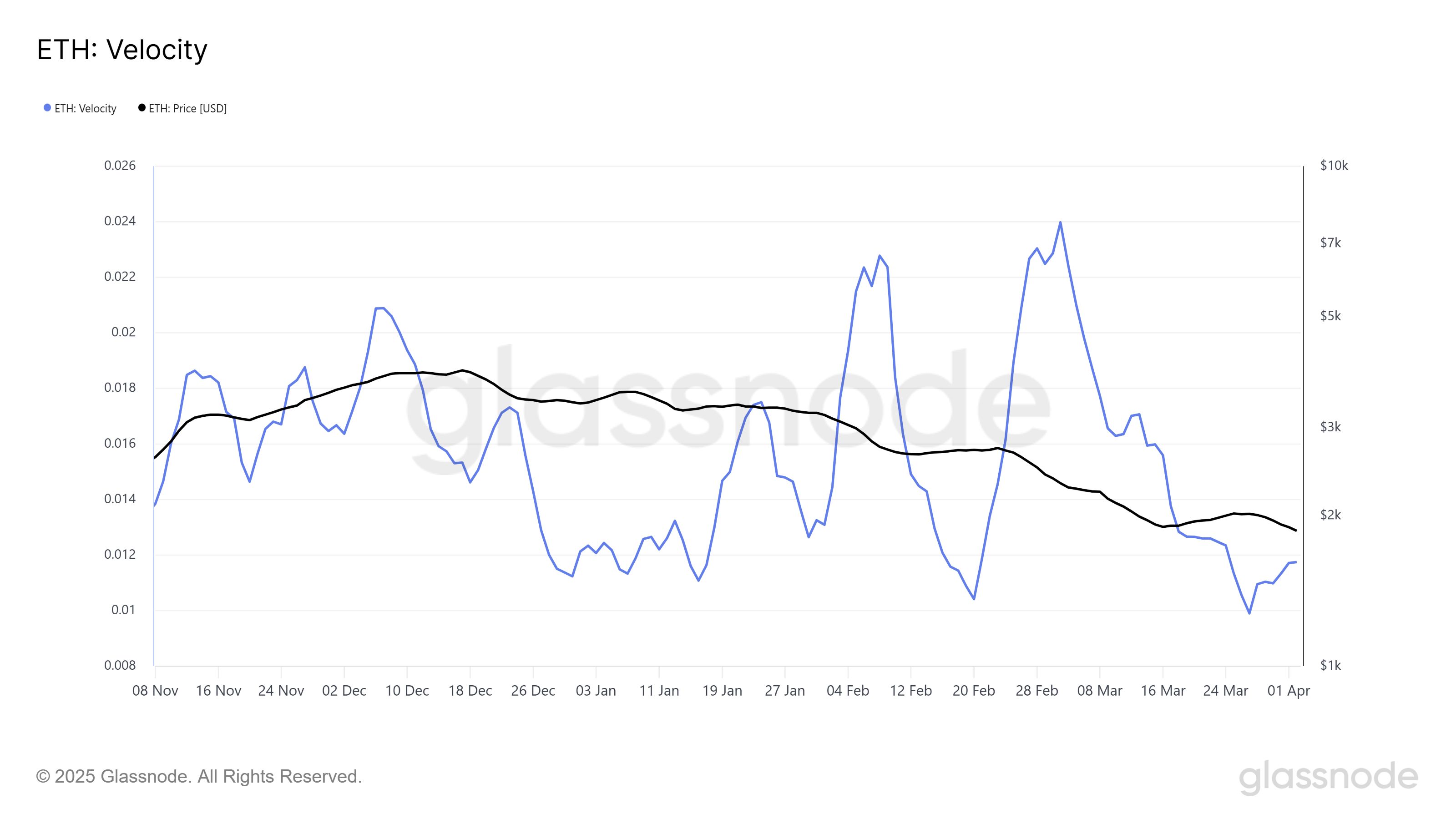

Many long-term holders of Bitcoin are choosing to retain their assets through these challenging market conditions. Data reveals that Bitcoin’s current velocity is at a five-month low, reflecting a substantial decrease in coins being transacted within the market. This trend indicates that investors are opting to hold rather than trade, which could be a strategic move in anticipation of a market rebound.

According to insights from Glassnode, a blockchain analytics company, this reluctance to sell among long-term holders ultimately stabilizes Bitcoin’s price amidst volatility. As many LTHs purchased Bitcoin during its all-time highs, their willingness to hold suggests a belief in the cryptocurrency’s long-term value and prospects.

Bitcoin Velocity. Source: Glassnode

Analyzing Key Support Levels for Bitcoin

As Bitcoin trades around $83,403, understanding key support levels becomes critical. Investors closely monitor the $85,000 resistance point and the subsequent support level at $80,301. If Bitcoin can reclaim the $85,000 mark, it would signal a potential upward reversal in market sentiment.

This analysis is critical considering the temporary dip following external events such as Trump’s tariff announcements, which can reshuffle market dynamics. A recovery above $85,000 could not only restore investor confidence but also encourage new inflows into the market.

Bitcoin Price Analysis. Source: TradingView

Future Outlook for Bitcoin’s Price Movement

Given the current market landscape, many analysts are cautiously optimistic. The sentiment among mid-term holders transitioning to long-term holders indicates a potential shift that could support price stabilization as they remain less inclined to sell during downturns.

However, should Bitcoin fail to maintain its momentum and drop below $80,301, a bearish scenario could play out, leading to further consolidation or decline. Hence, the vision of Bitcoin trading sustainably above $85,000 remains important not only for price recovery but for bolstering overall investor sentiment.

Conclusion

Bitcoin’s struggle beneath $85,000 signifies a cautious but determined investor landscape. With long-term holders displaying unwavering confidence and assuming a stabilizing role, the cryptocurrency prepares itself for potential recovery. Thus, reclaiming $85,000 becomes paramount as Bitcoin navigates through these essential market dynamics. Investors are keenly watching the trends as the path ahead unfolds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

33% of French looking to buy crypto in 2025 but Italians are even more bullish

Share link:In this post: A third of French people intend to purchase cryptocurrencies this year. New study shows Italians as most bullish among surveyed nations in Europe. The crypto sector’s growing legitimacy helps attract more investors, researchers say.

Spanish Police End Crypto Scam Ring That Used AI to Swipe $21 Million From Investors

Survey reveals 1 in 5 Americans own crypto, with 76% reporting personal benefits

Trade war hits Treasurys

10-year yield climbed Tuesday night, with the possibility that basis trade is unwinding