Bitcoin ETF & Derivatives Daily: ETF Appetite Grows While BTC Derivatives Cool

Bitcoin Spot ETFs have rebounded with $221 million in inflows, especially driven by Ark Invest's ARKB ETF. However, BTC futures open interest has dropped, and the options market shows a more pessimistic outlook.

Another day, another move in the markets. From fresh ETF inflows signaling institutional appetite to derivatives data revealing where traders are placing their bets, today’s analysis offers key insights into what’s driving price action.

Let’s break down the latest trends shaping the ETF and derivatives space.

Bitcoin Spot ETFs Rebound With $221 Million Inflows

The reduced cryptocurrency market activity noted in March caused BTC spot ETFs to record a monthly outflow of $767 million. However, with broader market recovery underway, April has started well.

On April 2, spot BTC ETFs saw a positive surge in inflows, with $221 million pouring into spot Bitcoin products. Ark Invest and 21Shares’s ETF ARKB led this influx, with a daily net inflow of $130.15 million, bringing its net assets under management to $4.14 billion.

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

However, not all funds shared this positive trajectory, as BlackRock’s ETF IBIT experienced net outflows totaling $115.87 million.

As of this writing, Bitcoin Spot ETFs have a total net asset value of $97.35 billion, representing 5.73% of the coin’s market capitalization of $1.65 trillion.

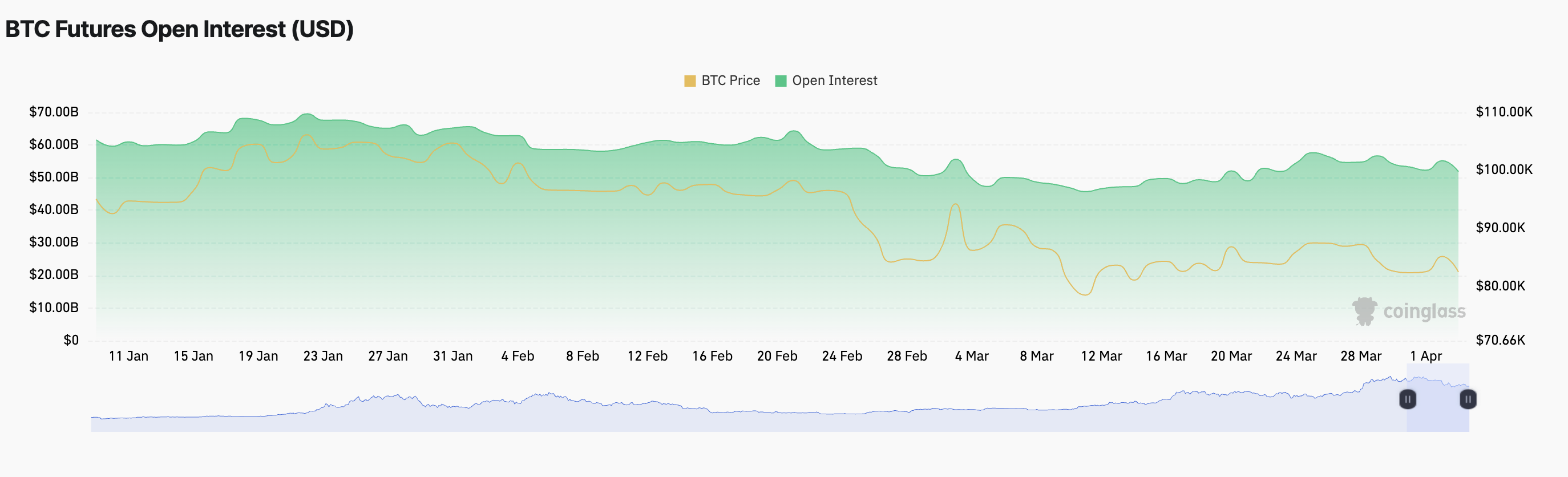

BTC Derivatives Activity Cools, Put Options Outpace Calls

Meanwhile, activity in the BTC derivatives market has declined, with the coin’s futures open interest plummeting 7% over the past 24 hours. At press time, per Coinglass data, this stands at $51.82 billion.

Bitcoin Futures Open Interest. Source:

Coinglass

Bitcoin Futures Open Interest. Source:

Coinglass

An asset’s open interest measures the total number of outstanding derivative contracts (such as futures or options) that have not been settled.

Notably, BTC’s value has dropped by 1% during the period in review, confirming the decline in trading activity. When BTC’s open interest falls alongside its value like this, it indicates that traders are closing positions rather than opening new ones, adding to the downward pressure on the coin’s price.

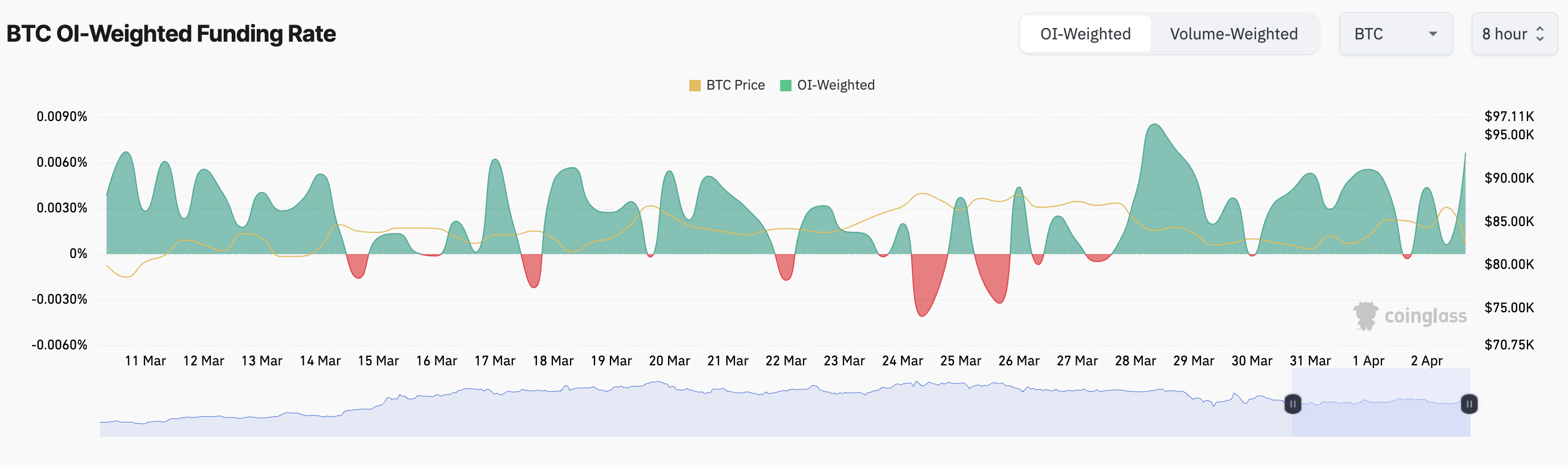

However, the coin’s positive funding rate offers some respite. At 0.0067% at press time, BTC’s funding rate reflects strong demand for long positions over short ones, highlighting holder resilience despite BTC’s price volatility.

Bitcoin Funding Rate. Source:

Coinglass

Bitcoin Funding Rate. Source:

Coinglass

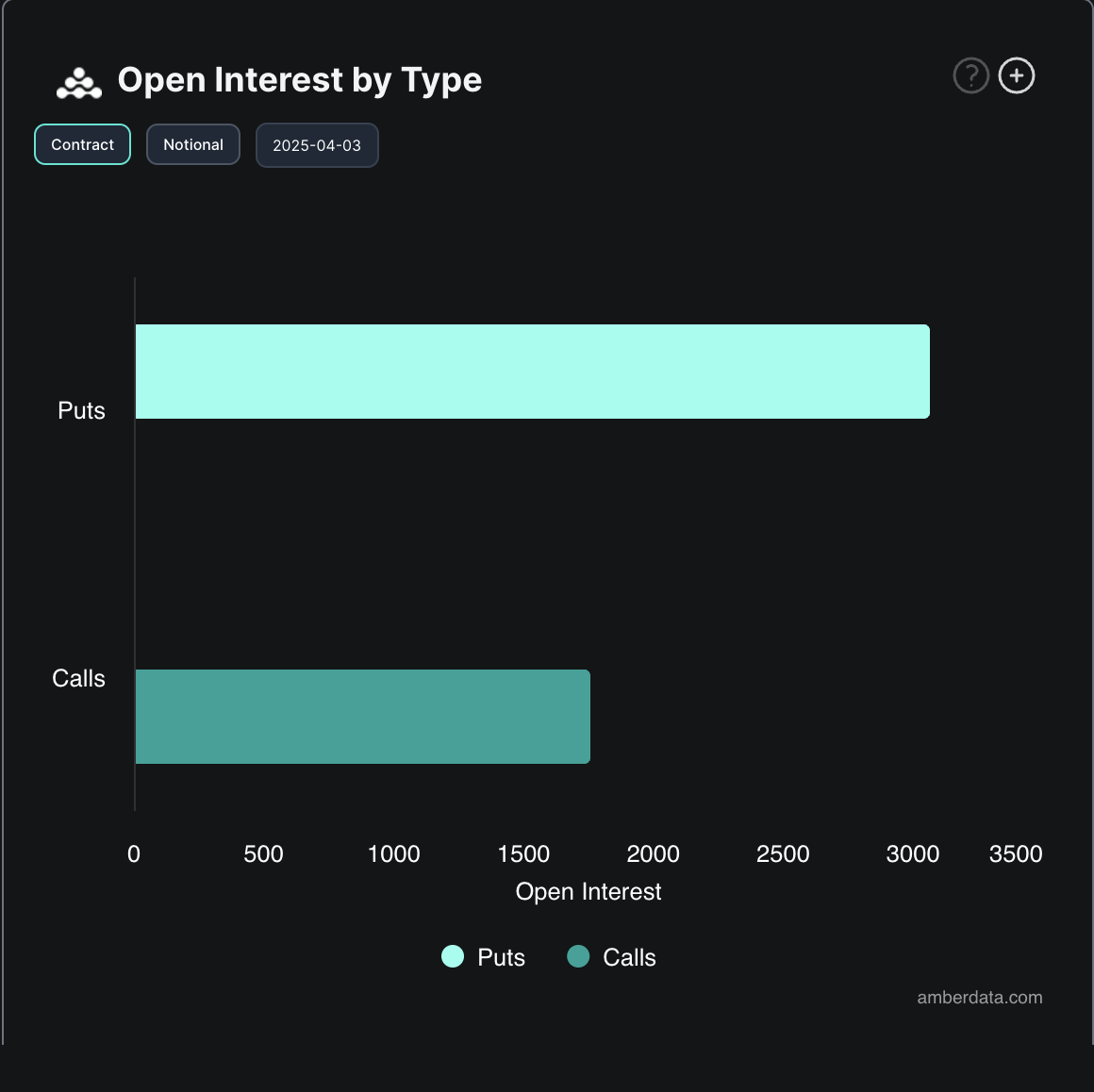

This bearish bias is also reflected in the options market today, with put options exceeding call options. This suggests that traders are increasingly betting on Bitcoin’s price falling or remaining stagnant, further reinforcing negative sentiment.

Bitcoin Options Market Data. Source:

Deribit

Bitcoin Options Market Data. Source:

Deribit

A higher number of put options like this signals that market participants are preparing for a potential downside, which could contribute to BTC’s further price weakness if this sentiment persists.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Onchain — Going Onchain, Without Going Onchain

Up to 50% BGB rebates: Deposit & buy crypto with VND today!