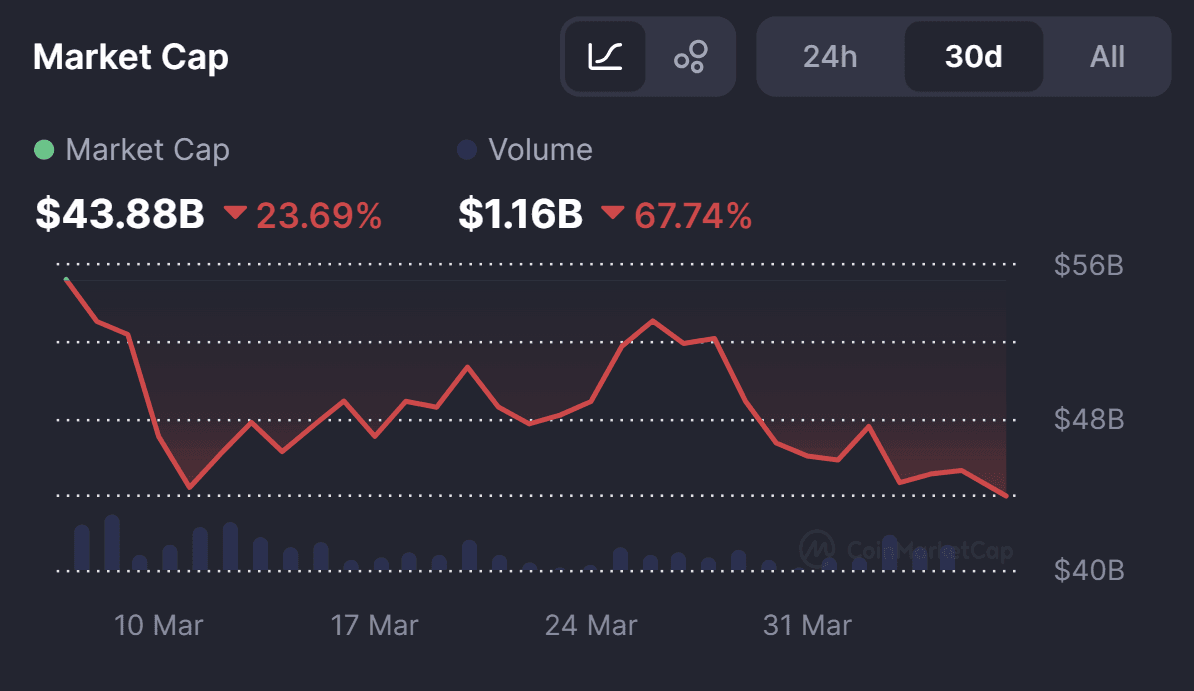

Bitcoin Whales Accumulate $1.75B: Is a Price Surge Next?

- Bitcoin whales successfully purchased 20,000 BTC totalling $1.75 billion since February 24 which indicates their belief in Bitcoin’s increased market value.

- A rise in whale ownership might decrease Bitcoin’s circulating supply which combines with higher prices but creates short-term price fluctuations.

- Market uncertainty has led to mass liquidations because leveraged investors experienced selling actions due to price movements.

Recent on-chain data suggests that whales have been significantly increasing their holdings. Since February 24, these entities have reportedly accumulated approximately 20,000 BTC, amounting to an estimated $1.75 billion. This substantial acquisition has raised discussions regarding potential market implications and strategic positioning by institutional and high-net-worth investors.

The data indicates increasing whale ownership of Bitcoin alongside periodic changes in their buying habits during the past week. The overall trend confirms ongoing accumulation of Bitcoin while brief dips exist but do not disrupt the future expansion potential of this digital currency.

Potential Market Implications

The recent accumulation phase could suggest multiple market scenarios. Firstly, it may indicate that influential investors anticipate a price increase, leading them to acquire more Bitcoin at current price levels before a potential surge. Historically, such trends have been observed before bullish market movements, as whales accumulate assets at relatively lower prices.

Additionally, increased whale accumulation can lead to liquidity constraints, reducing the available Bitcoin supply in circulation. While the accumulation trend is a positive sign for Bitcoin’s long-term prospects, short-term price volatility remains a possibility.

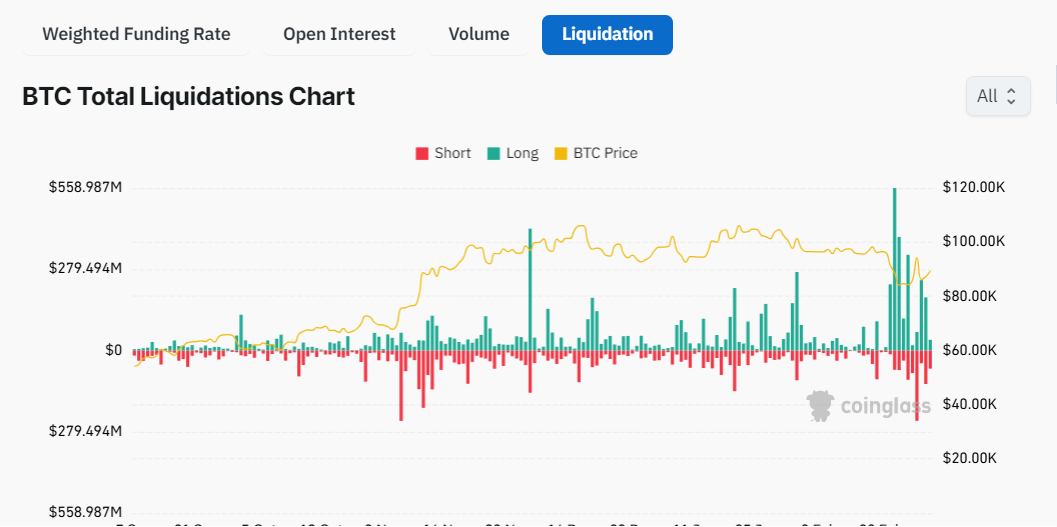

Bitcoin Liquidations Surge Amid Price Volatility

The BTC Total Liquidations Chart shows balanced price movements between Bitcoin and liquidations through small short-term fluctuations occurring in short and long positions. An increase in Bitcoin’s price results in liquidated short positions that demonstrate rising trader investments against the price increase

Source: Coinglass

Source: Coinglass

The price fluctuations demonstrate unexpected price movements that trigger traders to sell both long and short positions when Bitcoin’s value adjustment occurs. Liquidations seem to occur at a higher rate within the Bitcoin market which underscores intensified trading activity.

The recent Bitcoin market price fluctuations triggered extensive forced liquidations that impact both short-term and long-term investors. Pump-up effects from leveraged trading operations could explain why significant liquidations exist. Additional price volatility seems probable because traders will focus on major support and resistance levels in order to prevent upcoming massive forced position closings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Black Monday 2.0? 5 things to know in Bitcoin this week

Bitcoin battles everything from a "death cross" to record low sentiment as US trade tariffs wreak havoc across global markets — will 2021 prices return?

Bitcoin crashes 10% as crypto market wipes out $1.3 trillion in value since January

Top 5 RWA Tokens to Buy in April 2025 Before They Skyrocket