POL and NEAR Hit Major Support Levels Amid Significant Corrections: Is a Bounceback Ahead?

Date: February 2, 2025 | 08:43 AM GMT

The cryptocurrency market has been experiencing a significant correction since the rally between November and mid-December. Despite Bitcoin’s strong performance, Ethereum’s sluggish movement has delayed the anticipated altcoin rally.

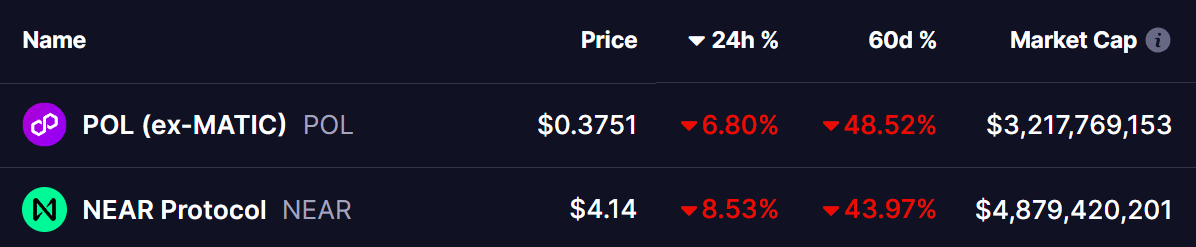

Adding to the downside pressure, Bitcoin dominance is currently retesting a key breakout level, which has pushed BTC below $100K. This has resulted in a broader sell-off across major altcoins, with Polygon (POL) and Near Protocol (NEAR) dropping 6% and 8%, respectively. Over the last 60 days, POL has declined by 48%, while NEAR has lost 43% of its value.

Source: Coinmarketcap

Source: Coinmarketcap

Polygon (POL) – Testing a Multi-Year Support Zone

The weekly chart for POL reveals that the price has been consolidating within a three-year-long descending triangle pattern. The recent downtrend, which started on December 2, was triggered by a rejection from the upper resistance of the triangle at $0.76.

Polygon (POL) Weekly Chart/Coinsprobe (Source: Tradingview)

Polygon (POL) Weekly Chart/Coinsprobe (Source: Tradingview)

This decline has now brought POL into a major support zone between $0.30 and $0.41, with the current price trading around $0.37. Historically, this level has served as a strong rebound zone, and if history repeats itself, POL could see a bounce from this support, potentially leading to a breakout from the multi-year triangle.

If POL manages to hold this support and initiate a reversal, the first target remains at $0.76. A breakout above this level could shift market sentiment and trigger a larger bullish move.

Near Protocol (NEAR) – Retesting Breakout Level

Near Protocol (NEAR) has gained attention due to its association with the AI narrative, drawing strong investor interest. Unlike POL, NEAR has already broken out of its long-term descending triangle. However, the broader market correction has dragged its price down from its December 2 high of $8.24 to the current level of $4.14.

Near Protocol (NEAR) Weekly Chart/Coinsprobe (Source: Tradingview)

Near Protocol (NEAR) Weekly Chart/Coinsprobe (Source: Tradingview)

This decline appears to be a retest of the breakout trendline, which aligns with a major horizontal support zone. If NEAR holds this level successfully, it could make a strong reversal back to its recent high of $8.24.

The accumulation phase that NEAR previously experienced in this zone suggests that buyers may step in again, preventing further downside.

Is a Bounceback Coming?

At this moment, both POL and NEAR are trading at major support zones. The next move will largely depend on Bitcoin dominance, which is currently retesting its rising wedge breakout level.

BTC Dominance 4H Chart/Coinsprobe (Source: Tradingview)

BTC Dominance 4H Chart/Coinsprobe (Source: Tradingview)

If BTC dominance confirms a rejection and resumes its downtrend, altcoins—including POL and NEAR—could see a strong recovery. This scenario could lead to a broader relief rally across the altcoin market. On the other hand, if BTC dominance continues rising, the altcoin market may remain under pressure, leading to further downside.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before making investment decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Whale Sells $5.48M in TRUMP Token, Gains $483K

A crypto whale offloaded 630,339 TRUMP tokens for $5.48M, pocketing nearly $483K in profit at $8.70 per token.Whale Exits TRUMP Token with Nearly Half a Million in ProfitSmart Profit-Taking or Early Exit?Whale Moves as a Market Signal

Buy Low, Fly High: Arctic Pablo at $0.000099 Eyes $0.008 Surge, While Fwog And Pudgy Penguins Push Boundaries

Explore Arctic Pablo Coin's presale, Pudgy Penguins' gaming expansion, and Fwog's market trends. Discover the Top New Meme Coins to Invest in April 2025.Arctic Pablo Coin (APC): Staking and RewardsArctic Pablo Coin (APC): Presale Reaches Frostbite CityPudgy Penguins: Expanding into Mobile GamingFwog: Gaining Momentum in the Meme Coin MarketWrapping Up: Arctic Pablo Coin (APC) Stands OutFor More Information:

Australian Court Overturns License Ruling Against Block Earner, Sides with Fintech in Landmark Crypto Case

In a significant legal win for Australia’s crypto and fintech industry, the Federal Court has overturned a previous ruling that required digital finance firm Block Earner to obtain a financial services license for its discontinued fixed-yield crypto product.

Symbiotic Raises $29 Million to Build Universal Staking Coordination Layer

Symbiotic, a decentralised finance (DeFi) protocol, has secured $29 million in a funding round led by Paradigm and cyber.Fund.