History suggests Bitcoin poised for rebound in July

Bitcoin may see a strong rebound in July following a lackluster performance in June, which saw Bitcoin falling almost 7% in the month, according to analysts

The price of Bitcoin ( BTC ) dropped as much as 6.96% last month and has historically averaged a slump of 0.35% in June, according to data from Coinglass — which tracks the monthly returns of Bitcoin beginning in 2013.

In a June 30 post on X, Ali Martinez, a crypto markets analyst, noted that in previous years, whenever June ends in a downtrend, the following month sees a roaring comeback, with Bitcoin gaining an average of 7.42% historically.

Overall, BTC has posted minimum monthly gains of 8% for seven of the last eleven July trading periods.

Memecoin analyst Murad also noted this in a post to their 103,000 followers on X, pointing to the swift historical rebounds beginning in July.

Murad noted that Bitcoin had posted minimum gains of 28% in the first few weeks of every July for the last six consecutive years.

However, several analysts predict that July could be a tougher month than usual, pointing to sizeable sales of Bitcoin from the German government and the upcoming Mt. Gox repayments which could put pressure on the price of Bitcoin.

Mt. Gox Bitcoin adds new pressure

These repayments are expected to see around $8.5 billion in BTC paid back to creditors starting in the first week of this month.

However, several analysts believe the impact of these repayments may not be as dire as many investors expect, with only $4 billion of this amount standing to hit the spot BTC market.

Related: Bitcoin price gets 'interesting' as triple candle close sees $61.5K return

Jonathan de Wet, chief investment officer at digital asset trading firm ZeroCap told Cointelegraph last week that Bitcoin had been trading strongly in a low to mid $60,000 range despite headwinds.

He said he expects the asset to hold around this level, but noted it could fall to its “key support” level at around $57,000 in the coming weeks as Mt. Gox creditor repayments hit the market.

Historically, Bitcoin’s best monthly performance tends to arrive in November, posting an average monthly gain of 46.81% since 2013.

Magazine — ‘Bitcoin Layer 2s’ aren’t really L2s at all: Here’s why that matters

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

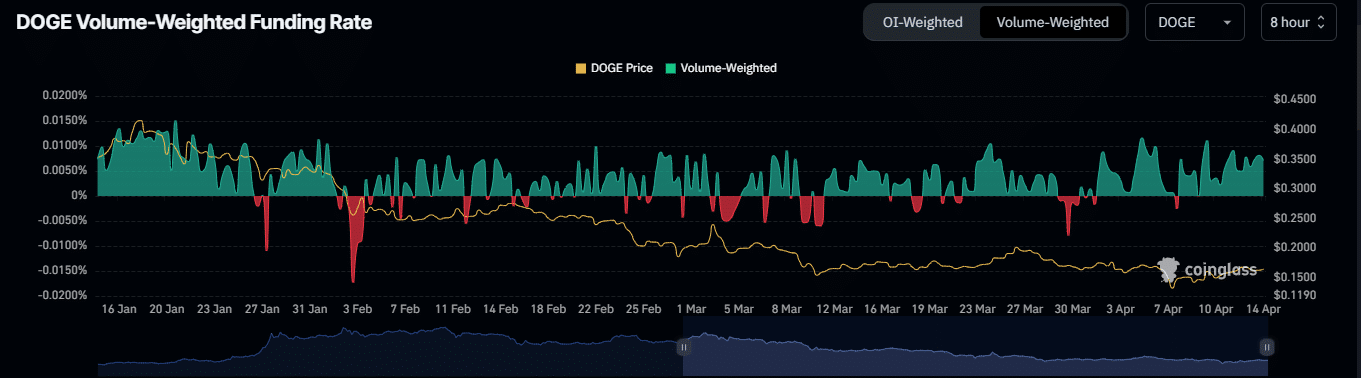

Potential Dogecoin Rally Ahead as Key Support Level and Increased Buying Interest Emerge

Market Insights: Short-Term Recovery Signals for BONK, ALCH, and Bitcoin

In Brief Analyst Pseudonym identifies recovery signals in BONK, ALCH, and Bitcoin. Short-term trading strategies recommended for cautious positions. Increasing interest in meme tokens amid market volatility.

Ethereum Price Fluctuations Ignite Technical Analysis and Strategic Forecasts

In Brief Ethereum's price fluctuations shift focus to technical indicators among market players. Analysts signal potential recovery and long-term growth opportunities for Ethereum. Competition from networks like Solana raises challenges for Ethereum's market position.

Market Turmoil: Investors React as OM Coin Crashes 90%

In Brief OM Coin experiences a dramatic 90% drop, alarming the crypto market. IP Coin's price decline raises investor concerns about potential panic sales. Support levels for IP Coin are being closely monitored following recent fluctuations.