First Mover Americas: XRP Gains 66% on Ripple’s Partial Court Victory

The latest price moves in crypto markets in context for July 14, 2023.

This article originally appeared in , CoinDesk’s daily newsletter putting the latest moves in crypto markets in context..

Ripple Labs a partial victory in its fight with the U.S. Securities and Exchange Commission (SEC) in a court ruling that brought a modicum of regulatory clarity for the cryptocurrency industry.The sale of Ripple’s XRP tokens on exchanges and through algorithms did not constitute investment contracts, a judge in the U.S. District Court for the Southern District of New York Thursday. However, the institutional sale of the tokens did violate federal securities laws, the judge ruled. XRP soared as much as 80% on the news with crypto exchanges Coinbase and Gemini among those saying they might list or re-list the token. Early reads from legal experts, though, suggest the ruling falls short of settling the question of whether and under what circumstances a digital asset meets the definition of a security under U.S. law.

Ripple’s has surpassed Binance’s BNB token to become the world's four-largest digital asset by market cap after its 66% post-court ruling advance brought its valuation to $41.44 billion, . BNB – which rallied 6.5% in wake of the court ruling – now has a market cap of $40.57 billion. Ripple bulls however, shouldn’t forget the second part of yesterday’s court decision. “The Court has found Ripple to be in violation of securities laws, specifically in relation to direct sales to institutional investors,” wrote CoinShares’ Head of Product Townsend Lansing in an email to CoinDesk. “As such, XRP is not only deemed a security, but questions have arisen regarding the legality of its offering,” he continued. “In regards to these sales, the Court has confirmed that the law was indeed violated, marking a considerable victory for the SEC and setting a precedent for its legal actions against other cryptocurrencies."

Alex Mashinsky, co-founder and former CEO of insolvent crypto lender Celsius, was in New York on Thursday following an investigation into the company's collapse, the U.S. Department of Justice (DOJ) confirmed to CoinDesk. Mashinsky and others are charged with seven criminal counts including securities fraud, commodities fraud, wire fraud and conspiracy to manipulate the price of Celsius' token CEL, according to the unsealed DOJ indictment. The criminal charges were accompanied by three separate lawsuits against Mashinsky and Celsius by the U.S. Securities and Exchange Commission (SEC), and .

- Omkar Godbole

Edited by Stephen Alpher.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

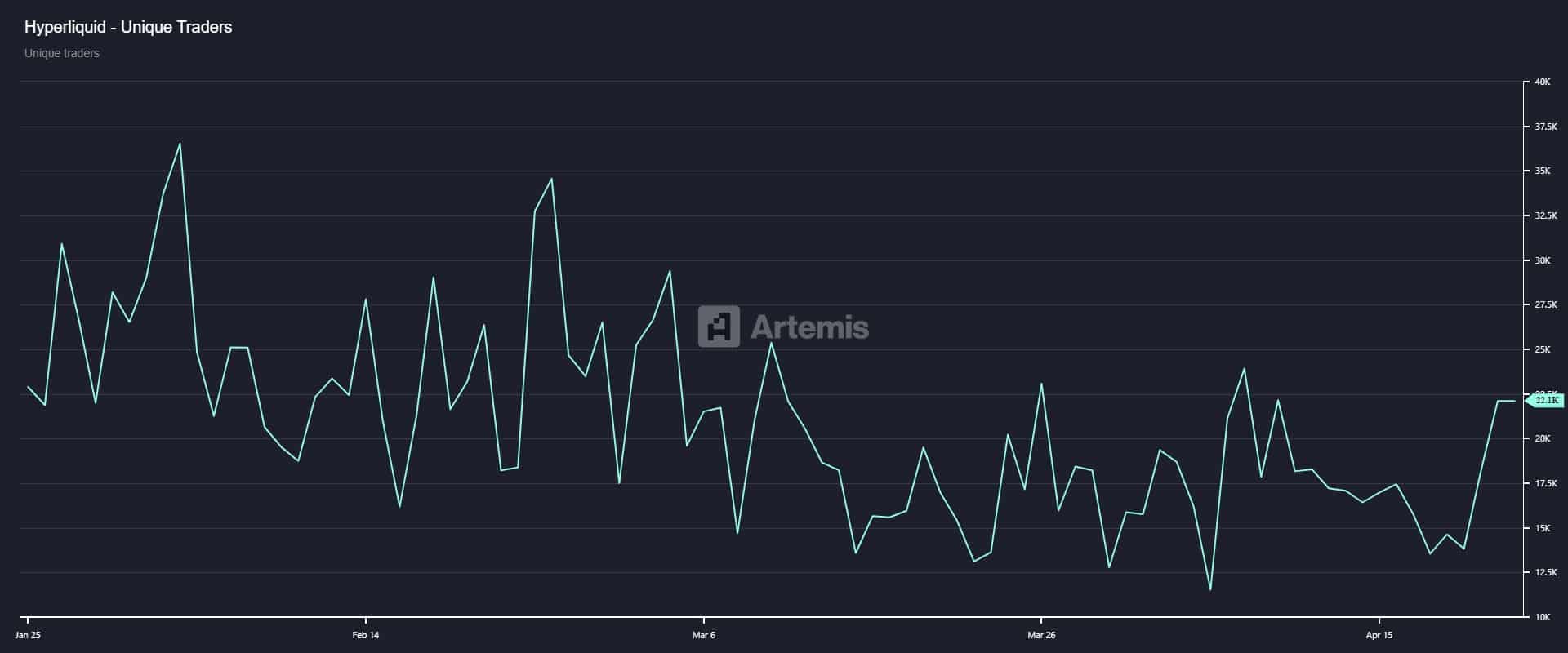

HYPE Surpasses TRX in Fee Generation; Questions Arise About Long-Term Dominance

INIT is live! Bullish or bearish? Join to share 3,432 INIT!

XRP Network Explodes with 67% Growth—Here’s What It Means for the Price

VIPBitget VIP Weekly Research Insights

In 2025, the stablecoin market shows strong signs of growth. Research indicates that the market cap of USD-pegged stablecoins has surged 46% year-over-year, with total trading volume reaching $27.6 trillion, surpassing the combined volume of Visa and Mastercard transactions in 2024. The average circulating supply is also up 28% from the previous year, reflecting sustained market demand. Once used primarily for crypto trading and DeFi collateral, stablecoins are now expanding into cross-border payments and real-world asset management, reinforcing their growing importance in the global financial system. More banks and enterprises are starting to issue their own stablecoins. Standard Chartered launched an HKD-backed stablecoin, and PayPal issued PYUSD. The CEO of Bank of America has expressed interest in launching a stablecoin once regulations permit (via CNBC). Fidelity is developing its own USD stablecoin, while JPMorgan Chase and Bank of America plan to follow suit when market conditions stabilize. Meanwhile, World Liberty Financial (backed by the Trump family) has introduced USD1, backed by assets such as government bonds and cash.