News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1 Bitget Daily Digest (Dec. 18)|U.S. SEC issues a Statement on the Custody of Crypto Asset Securities by Broker-Dealers; LayerZero (ZRO) to unlock ~25.71 million tokens on Dec. 202Bitget US Stock Morning Brief | S&P 500 Four-Day Decline; Oracle AI Financing Stalls; Energy & Precious Metals Rally; Micron Crushes Guidance, Surges After Hours (December 18, 2025)3SEC says broker-dealers need to maintain crypto private keys to comply with customer protection rules

Is the DA war coming to an end? Deconstructing PeerDAS: How can it help Ethereum reclaim "data sovereignty"?

Odaily星球日报·2025/12/18 07:14

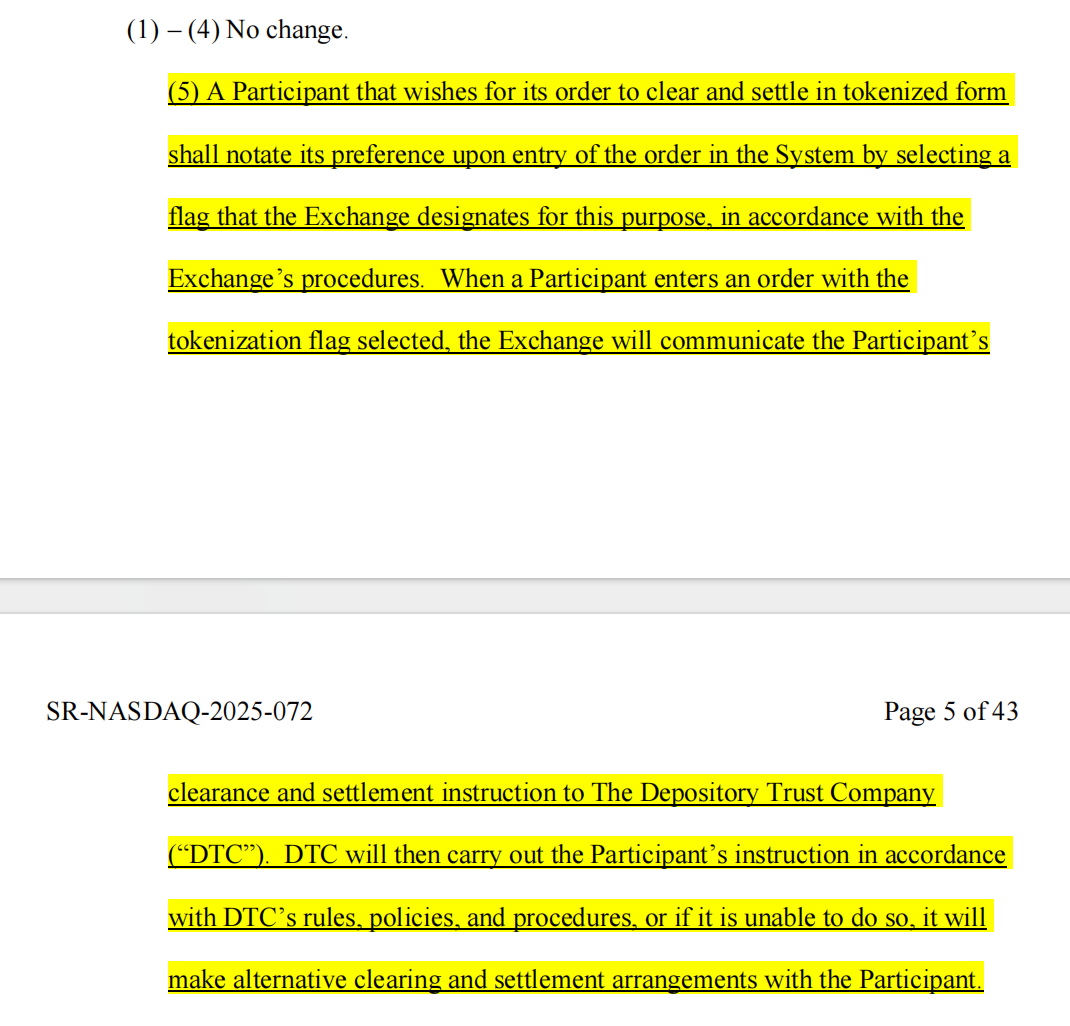

Frontline Report | Web3 Lawyers Interpret the Latest Developments in US Stock Tokenization

Odaily星球日报·2025/12/18 07:14

Why did the "Insider King" fall into his own trap on October 11?

AIcoin·2025/12/18 07:07

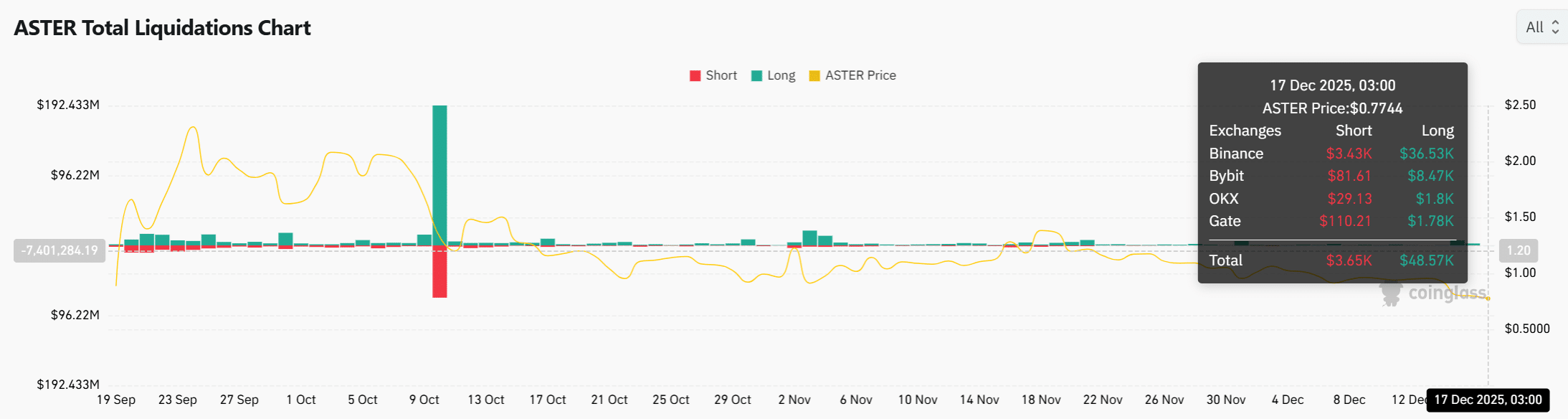

ASTER price sinks as whale losses deepen – Is $0.6 next?

AMBCrypto·2025/12/18 07:03

Dark Defender: Narrative Will Continue to Shift In Favor of XRP. Here’s why

TimesTabloid·2025/12/18 07:03

Revealing the Edge: Longs Hold Slight 50.57% Lead in BTC Perpetual Futures

Bitcoinworld·2025/12/18 06:42

MSCI Crypto Delisting: The Alarming $15 Billion Threat to Bitcoin Markets

Bitcoinworld·2025/12/18 06:27

Bitcoin's Price Ceiling Tightens as Loss-Holders Sell

Decrypt·2025/12/18 06:09

Caroline Ellison Shifted to Community Custody Before 2026

Cryptotale·2025/12/18 06:06

Bitcoin Price Resistance: The Critical $95K Test That Could Make or Break the Rally

Bitcoinworld·2025/12/18 06:03

Flash

07:21

RIVER briefly reached 3.46 USDT, with a 24-hour increase of 62.44%Foresight News reports that according to Bitget market data, RIVER briefly reached 3.46 USDT and is now quoted at 3.3 USDT, with a 24-hour increase of 62.44%.

07:20

Analyst: The overall macro market environment is neutral, with no clear directional trend emerging at present.Jinse Finance reported that Cryptoquant analyst Axel Adler Jr released a market analysis stating that the overall macro market environment remains neutral: although the MOVE index has slightly rebounded, the US Dollar Index continues to support risk appetite, and the yield curve of 2-year and 10-year US Treasury bonds remains stable, with no fluctuations in real yields. However, the stock market is sending localized risk-off signals (the S&P 500 index fell by 0.98%), so the current market structure is still in a balanced state, with a medium risk level (5/10), and no clear directional trend has emerged yet.

07:20

Opinion: Recent US Employment Data is "Alarming", Fed Has Reason to Implement "Insurance" Rate Cut Next YearBlockBeats News, December 18th, according to analysis by UBS, this week's job report revealed a potential softness in the US labor market, which could serve as a basis for the Federal Reserve to further cut interest rates early next year. UBS Chief Economist Paul Donovan pointed out in a note to clients that this data "sounded alarm bells" in many areas. Due to the government shutdown exacerbating the issue of low response rates in the Labor Department's survey, caution is needed in interpreting the quality of the data.

Morgan Wealth Management's Investment Strategy Director Elyse Ausenbaugh also expressed concerns, especially about the October data. She stated that this report reinforces the market's view of the current Fed policy path. The past few months of "insurance" rate cuts have been a cautious move to bring rates back to a more neutral level. She believes that a further rate cut in the first quarter of 2026 may be appropriate, but for now, the economy remains stable, and the Fed is patiently observing for future action. (FXStreet)

News